-1.png?width=1574&height=714&name=Interview%20Blog%20Header%20(11)-1.png)

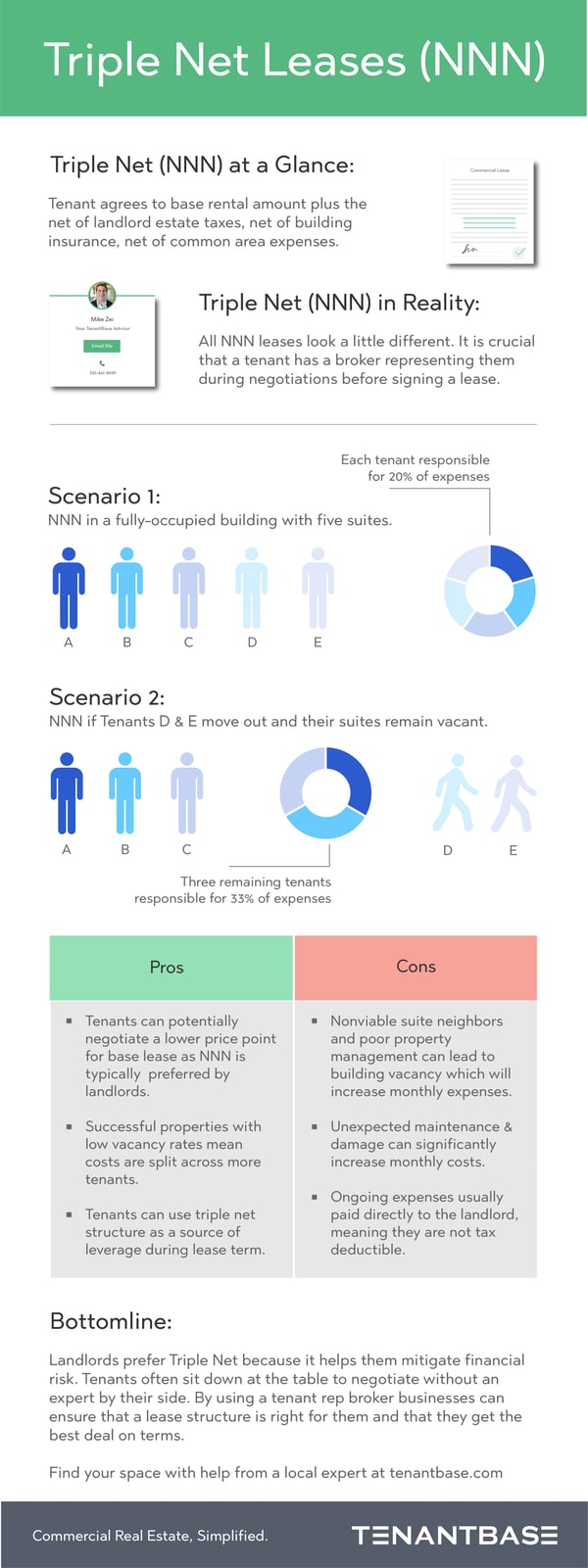

Triple Net Lease: The Pros & Cons

Triple Net Lease | The Brief

A lot of our clients ask us "what are the benefits or drawbacks of signing a Triple Net Lease?" While a triple net lease might appear to heavily favor landlords in light of the extra costs and tax inefficiencies but that doesn’t have to be the case. If you negotiate well and leverage your advantages to maximum impact, a triple net lease could be a financial benefit to your company.

Triple Net Lease | The Full Story

Businesses must weigh the pros and cons of every decision to find what works best for them. The triple net lease is an excellent example of this with benefits that make them attractive for some tenants and challenges that make them a hindrance to others.

To help you make the best decisions for your organization, TenantBase has put together some thoughts to consider regarding a triple net lease. Take into account your own specific goals and expectations when choosing between lease types and not necessarily what happens to be trending in commercial office space at the time. TenantBase is here to guide you as you go by lending our expertise and experience to your office space needs.

What Is a Triple Net Lease?

A triple net lease is less complicated than it sounds. Often referred to as an NNN lease, a triple net lease is an arrangement where the tenant pays either a portion or all of an office space’s ongoing expenses in addition to the base rent. These ongoing expenses include line items related to property taxes, building insurance, and maintenance costs.

Benefits of a Triple Net Lease

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.

Successful properties with low vacancy rates also make triple net lease attractive for a tenant as the taxes, insurance, and maintenance costs are divided by a greater number of fellow tenants. By spreading those expenses out among more lessees you pay a smaller prorated amount of the ongoing costs while still enjoying a lower monthly base rent. A similar idea exists for newer or well-maintained buildings where ongoing maintenance costs are typically nominal and represent lower monthly costs for tenants.

Tenants can also use the particulars of a triple net lease as a source of leverage during lease negotiations. Use your creditworthiness as a bargaining tool to lower the base monthly rate even lower since the landlord will favor tenants with a solid track record of financial responsibility. Using an experienced TenantBase advisor can help you take full advantage of such leverage and make a triple net lease work in your favor.

Drawbacks to a Triple Net Lease

There is an inherent danger in using a triple net lease with regards to the unknown. Unexpected and substantial damage to the property could significantly increase your monthly maintenance and repair costs. It is also crucial for you to carefully inspect the nature and viability of your fellow tenants as an uptick in vacancy will directly impact your ongoing monthly expenses. Also, remember that the ongoing expenses in a triple net lease are typically paid directly to the landlord and therefore a tenant usually cannot deduct them on their taxes.

A triple net lease might appear to heavily favor landlords in light of the extra costs and tax inefficiencies but that doesn’t have to be the case. If you negotiate well and leverage your advantages to maximum impact a triple net lease could be a financial benefit to your company. Use TenantBase’s expertise throughout your search and lease negotiations to make sure your new space works for you and not against your goals and potential.

Additional Resources

If you'd like to learn more about triple net leases, we encourage you to create a free account with TenantBase and talk to one of our local advisors. Their expertise is at no cost to businesses looking to lease space, and they can help you every step of the way.

If you're still in the research phase, the following resources are great to learn more:

.png?width=1574&height=714&name=Interview%20Blog%20Header%20(11).png)